Instrument Return on Investment Calculator

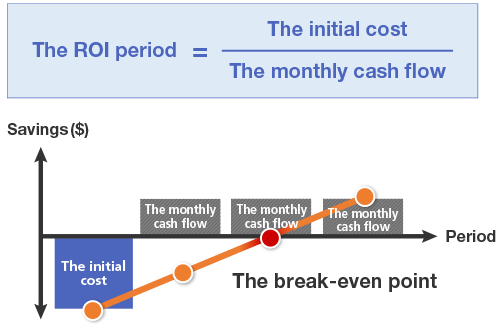

When buying an instrument, it is crucial to calculate its ROI (Return on Investment) to determine its future profitability. The ROI period should take into account the instrument's lifetime as well as maintenance costs. For instance, if maintenance costs are high, the ROI period may be longer. Considering these factors while calculating the ROI period is an essential criterion in the selection of instruments.

However, focusing only on the ROI period can also be problematic. When purchasing an instrument, there are other factors to consider such as post-purchase support structure, application quality, future scalability, and instrument size. If you only focus on the ROI period, you may overlook these important factors. Therefore, when calculating the ROI period, it is crucial to consider it from a comprehensive perspective.

Items to be entered by an instrument operator

Budget to purchase an instrument

The number of samples per month

Consumable cost per sample

Time required by a lab tech for sample prep and data analysis

Outsourcing fee for the analysis if the instrument is not purchased

(if you work for a production lab, the fee you charge your customer per sample)

(Enter 500 if not sure)

Budget for an annual maintenance

(Enter 5 % of the “Budget to purchase an instrument”)

Results

-

The time length for an instrument to be paid off

monthsOutsource or purchase?

(The instrument's life is assumed to be 10 years, and the outsourcing cost is US$500 per sample.)Monthly cash flow after the instrument has been paid off

USD / month -