CFO’s Vision and Priorities

I assumed the role of CFO in April 2025. I have accumulated experience in accounting and finance through roles in the corporate division, a business division, and an overseas subsidiary. Drawing on this background, I have led initiatives aimed at strengthening our financial foundation and achieving key financial KPI targets.

In the medium-term management plan from FY2023 to FY2025, I will focus on four key areas to pursue profitability and efficiency: (1) strengthening cash generation capabilities, (2) capital allocation to support growth investments, (3) business management through ROIC-based management, and (4) shareholder returns linked to profit growth. Even in a highly uncertain business environment, I remain committed to implementing financial strategies that support sustainable growth and contribute to the enhancement of corporate value.

Progress of the Medium-Term Management Plan

In the medium-term management plan (FY2023–FY2025), we aim to strengthen both our technological development capabilities and our ability to implement solutions in society. By enhancing the provision of end-to-end solutions for our customers, we seek to sustainably improve both growth potential and profitability. Our goal is to establish a stable profit structure and achieve long-term growth as an innovative company that solves social issues with global partners.

The performance in FY2024 benefited from favorable exchange rates driven by the expansion of our overseas operations, resulting in recordhigh net sales for the fifth consecutive year. We saw growth across our four strategic focus domains̶Healthcare, Green, Materials, and Industry. In the Healthcare domain, sales of liquid chromatographs grew in applications for pharmaceuticals and clinical testing. In the Green domain, sales of mass spectrometer systems expanded, particularly for the analysis of per- and polyfluoroalkyl substances (PFAS). In the Materials domain, sales of testing machines grew in response to demand for new material development. In the Industry domain, sales rose for turbo molecular pumps used in semiconductor manufacturing equipment and for aircraft-mounted components in the defense sector.

However, excluding currency effects, results fell short of our initial growth expectations due to a downturn in the Chinese market and sluggish investment in medical equipment in Japan. Furthermore, inflation and increased growth investments were not fully offset by our sales growth. As a result, the operating profit margin declined to 13.3% (down 0.9 points year-on-year), and ROE fell to 10.9% (down 1.6 points year-on-year). We regard improving profitability as a top priority and are taking steps to enhance our earning power. These include expanding high-margin businesses, consistently executing value-added pricing strategies, and reducing costs through improved operational efficiency using AI.

Promotion of ROIC-Based Management

Starting in FY2024, we introduced ROIC as a management indicator and have begun managing performance based on ROIC. We are working to establish KPIs that measure both profitability and efficiency, combining financial KPIs̶such as operating profit margin and invested capital turnover̶ with operational KPIs that reflect frontline activities, including the number of customer inquiries and production lead time. These KPIs will be organized in a hierarchical structure with ROIC at the top, allowing us to link management and frontline activities to company-wide objectives and promote enterprisewide optimization. Through this framework, we aim to advance business management with a strong focus on capital efficiency.

To optimize invested capital, we evaluate each business unit̶our core unit of business management̶based on ROIC and market attractiveness, and allocate management resources accordingly. Through this approach, we aim to expand high-profit businesses and improve asset efficiency. By steadily promoting these initiatives, we are committed to achieving our medium-term management plan target of ROIC at 11.0% or higher, thereby continuously generating added value that exceeds our cost of capital (7–8%) and strengthening our ability to create sustainable corporate value.

Increasing Working Capital Efficiency

Through continued efforts to enhance profitability, we have strengthened our cash generation capabilities. We are also rigorously managing our financial foundation by rigorously controlling working capital, including inventory and accounts receivable. As a result, we have maintained a healthy financial position, with an equity ratio consistently exceeding 70.0%.

As part of our efforts to utilize funds efficiently, we have expanded the cash management system (CMS), which had previously been implemented in Japan, to the United States, Europe, Asia, and China. As a result, approximately 80% of the Group’s funds are now managed through the CMS.

Our Group has adopted a policy of centralizing funds at headquarters and is working to enhance the effective use of funds and improve capital efficiency, thereby building a financial foundation that allows for continuous and agile investments necessary for growth.

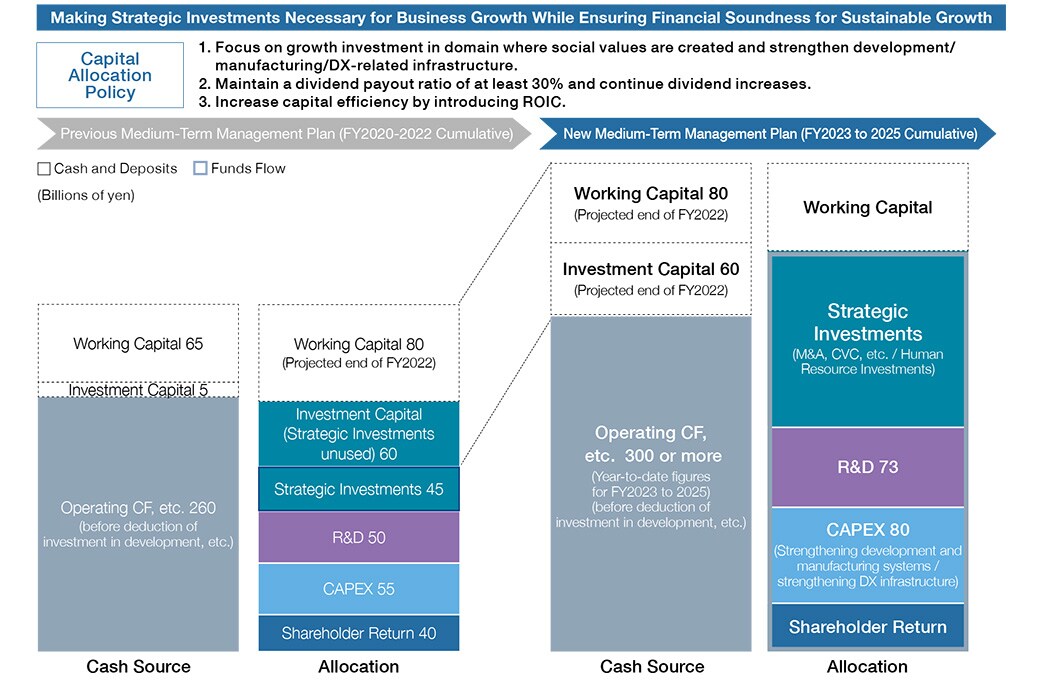

Capital Allocation

Under the medium-term management plan, we aim to generate a cumulative total of 300 billion yen in operating cash flow over three years, before deducting development investments. These funds will be appropriately allocated to development investments, capital expenditures, and strategic investments that drive growth, with timing optimized to maximize their effectiveness.

In FY2024, we actively promoted growth investments through research and development and capital expenditures, achieving progress largely in line with our expectations. Key initiatives included the establishment of a new R&D center in North America and the expansion of a plant in China to advance local production for local consumption. Regarding M&A, we acquired Zef Scientific, Inc., an analytical and measuring instrument service company in North America, in order to strengthen our foundation for expanding recurring-revenue businesses in the region. For strategic investments, including M&A, we will continue to pursue returns that exceed our cost of capital, while carefully evaluating each opportunity’s contribution to earnings, cash flow, and ROIC.

Shareholder Returns

The Shimadzu Group aims to deliver value to shareholders and investors by actively reinvesting profits into growth opportunities to enhance performance and by increasing the share price.

Regarding shareholder returns, we changed our policy starting from FY2023, the first year of the medium-term management plan, to “maintain a dividend payout ratio of 30% or more while comprehensively considering earnings and cash flow conditions and continuously implementing shareholder returns.” In FY2024, we increased dividends for the 11th consecutive year and, to further enhance shareholder returns and improve capital efficiency, conducted our first-ever share buyback as a Group, totaling 25 billion yen.

The Shimadzu Group regards enhancing total shareholder return (TSR)̶through stable and continuous dividend increases in line with medium- to long-term profit growth and the formation of an appropriate share price that exceeds the cost of equity capital̶a key management priority. While striving to strengthen our corporate foundation and expand long-term corporate value, we will continue to return profits to shareholders through dividends.

| Past 5 Years | Past 10 Years | |

|---|---|---|

| Total Shareholder Return | 140.3% | 306.6% |

- *The formula for calculating Total Shareholder Return (TSR) for each fiscal year is as follows:

(Term-end share price for the fiscal year divided by cumulative dividends per share from nine fiscal years prior, or four years prior in the case of a five-year period, up to the current fiscal year) divided by the share price at the end of the fiscal year ten years prior, or five years prior in the case of a five-year period.

Comment to Shareholders and Investors

In an era of heightened volatility driven by inflation, exchange rate fluctuations, technological advancement, and geopolitical risks, it is increasingly difficult to predict the future. Under such conditions, it is crucial to anticipate a wide range of potential scenarios, lay the groundwork in advance, and manage the business in a way that mitigates risks while seizing opportunities. I believe that my role is to maximize the outcomes of our business initiatives through the optimal allocation of management resources and robust risk management.

Historically, the Shimadzu Group has taken a cautious financial stance, placing emphasis on preparing future risks. However, under the current medium-term management plan, we are making a major strategic shift toward a more proactive financial approach to drive further growth, including bold investments. Through these efforts, I am confident that we will deliver a transformed and significantly evolved Shimadzu Group. We appreciate your continued support and look forward to sharing our progress with you.

Career History

| Apr. 1998 | Joined Shimadzu Corporation | |

| Apr. 2002 | Administration Department, Analytical & Measuring Instruments Division | |

| Oct. 2005 | Seconded at Kratos Group PLC (UK) | |

| Oct. 2013 | Manager, Finance Department | |

| Apr. 2018 | Manager, Planning Group, Finance and Accounting Department | |

| Apr. 2021 | Deputy General Manager, Finance and Accounting Department | |

| Oct. 2021 | General Manager, Finance and Accounting Department | |

| Apr. 2023 | Corporate Officer, General Manager, Finance and Accounting Department | |

| Apr. 2025 | Managing Executive Officer, CFO (current) |